Exercices

Exercice 1

The Company LDS purchased office furniture on 18 June of year "N" for $7200 including tax, the VAT rate is 20%. The company uses linear amortization. The useful life of the asset is five years. The financial year-end is the end of December.

Step 1: Price Before Tax

Price Excluding Taxes =

Price Including Taxes = $7200

VAT Rate = 20%

Price Excluding Taxes = = $6000

Step 4: Used days

Used days =

Since we bought the furniture on 18 June, we have to calculate the amortization for the first year.

Used days = 192 days

Step 7: Recording for 1st Year

Account for Depreciation, Amortization and Provision = 68

Account for amortization of fixed assets = 28

Exercice 2

Invoice N°112 19/04/2023

Industrial tools: $35 000

VAT 20% : $7 000

Net to be paid : $42 000

The equipment will be commissioned on 25 May. The depreciation period is 7 years (in degressive mode).

Step 1: Price Before Tax

The price before tax is already provided as it is $35 000. We can make sure by calculating it:

Price Excluding Taxes =

Price Excluding Taxes = = $35 000

Step 2: Rates

Linear Rate =

Degressive Annuity rate =

| Duration | Original Coefficient |

|---|---|

| Between 3 and 4 years | 1.25 |

| Between 5 and 6 years | 1.75 |

| More than 6 years | 2.25 |

Linear Rate = = 0.14 = 14%

Degressive Annuity rate = 32.14%

Step 3: Used months

Used months =

Since we commissioned the equipment on 25 May, we have to calculate the amortization for the first year.

Used months = 8 months

Step 4: Amortization for First Year

Amortization for First Year =

Amortization for First Year = $7499,33

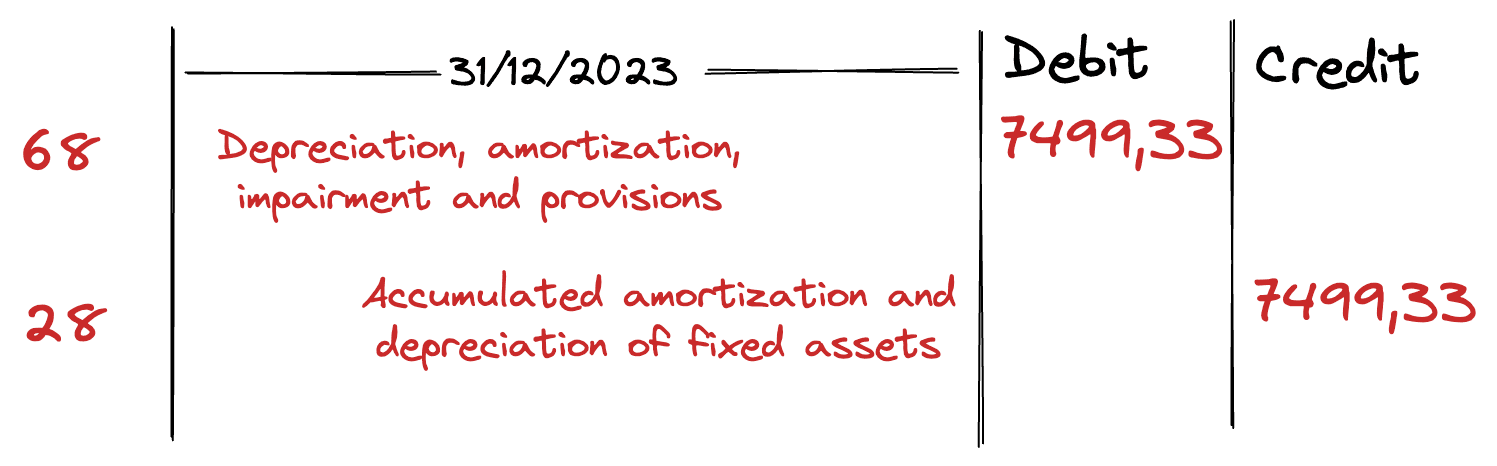

Step 6: Recording for 1st Year

Account for Depreciation, Amortization and Provision = 68

Account for amortization of fixed assets = 28

Exercice 3

-

Garel: amount of the receivable 8,820 $ including tax (VAT 20%). We expect to recover 70% of the debt.

-

Pépin: amount of the receivable 6,024 $ including tax (VAT 20%). Evaluation of the probable loss: 40%.

Step 1: Amount of the Receivable

Amount of the Receivable =

Amount of the Receivable for Garel = = $7 350

Amount of the Receivable for Pepin = = $5 020

Step 2: Provision

Provision =

For Garel, the provision is the opposite of what we can recover, thus: 30%. (100% - 70%)

Provision for Garel = $2 205

For Pepin, the provision is the percentage of the possible loss, thus: 40%.

Provision for Pepin = $2 008

Step 3: Recording

Account for Depreciation, Amortization and Provision = 68

Account for provision for receivables = 49

Exercice 4

| Customer | Amount incl. VAT | Amount excl. VAT | Existing Provision (%) | Payment in N | Observation | | -------- | ---------------- | ---------------- | ---------------------- | ------------ | --------------- | | A | 10080 $ | 8400 $ | 30% | 5382 $ | Last payment | | B | 3120 $ | 2600 $ | 15% | 598 $ | Increase to 30% | | C | 6420 $ | 5350 $ | 25% | 3100 $ | Last payment | | D | 4440 $ | 3700 $ | 40% | 4440 $ | - | | E | 9000 $ | 7500 $ | 35% | 4100 $ | Reduce to 20% |

Customer A

Step 1: Amount After Payment

Amount After Payment =

Amount After Payment for Customer A = $4 698

Step 2: Amount excluding VAT

Amount excluding VAT =

Amount excluding VAT for Customer A = $3 915

Step 3: Existing Provision

Existing Provision =

Existing Provision for Customer A = $2 520

Step 4: Loss

Since it is the last payment, the loss is the remaining amount after payment (excl. taxes) that the customer will never pay back.

Loss = $3 915

Step 5: Loss VAT

Loss VAT =

Loss VAT for Customer A = $783

Step 6: Provision Needed

Since we declared a loss, the provision needed is now 0.

Step 7: Depreciation or Reversal

The existing provision is $2 520 and the provision needed is 0. Thus, we need to reverse the provision (needed < existing).

Step 8: Table

Customer B

Step 1: Amount After Payment

Amount After Payment =

Amount After Payment for Customer B = $2 522

Step 2: Amount excluding VAT

Amount excluding VAT =

Amount excluding VAT for Customer B = $2 101,67

Step 3: Existing Provision

Existing Provision =

Existing Provision for Customer B = $390

Step 4: Loss

Since it is not the last payment, there is no loss.

Step 5: Provision Needed

Provision Needed =

Provision Needed for Customer B = $630,50

Step 6: Depreciation or Reversal

The existing provision is $390 and the provision needed is $630,50. Thus, we need to depreciate the provision (needed > existing).

Step 7: Table

Last updated on